When I first found my passion for photography, I never realized that it could evolve into my full time career. Like so many others, I fell in love with the craft and the business followed as a way to pursue my passion. Something that I learned early on, is that in order to truly succeed as a full time professional photographer, I must be a Small Business Owner first and a Creative Artist second.

And let me be honest with you… Running a Small Business is very, very hard. I’m not going to sugar-coat it. I’m not going to pretend that there aren’t days when I wonder why, oh why, I am just crazy enough to chase after my dream. There are times when my life is a constant breathless marathon of shooting, editing, emailing, and the million other hats that I wear as a business owner. But I made a choice very early on in my life, that I would rather work 60-hours a week following my heart and running my own business, than 40-hours in a back office cubicle.

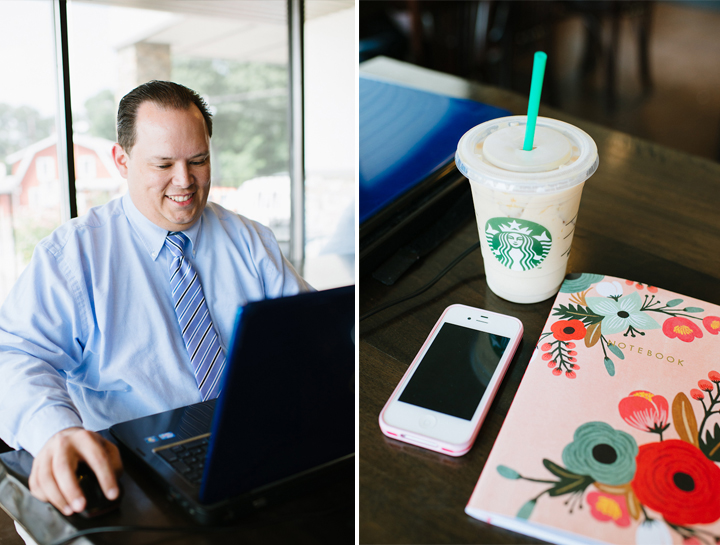

At the beginning of this year, just after filing as an LLC, I sat down with an extremely knowledgeable business accountant named Tom Barnhill. In so many ways, we are very similar creatures, both passionate business owners chasing after our piece of the American Dream, but there is one BIG difference between Tom and I. Tom’s passion isn’t in creating art, but rather in crunching numbers. He dreams about neatly stacked columns, perfectly punctuated formulas, and all of the various gears that make a business succeed.

Having Tom as a part of my business plan was one of the best decisions that I ever made. With my future goals in mind, we sat down and Tom drafted a financial plan, took over my monthly record-keeping, and helped me to establish a cash-flow that takes into account the seasonal nature of wedding photography. He has handled all of the financial workings of my business so that I can focus on what I love most… being a photographer.

From automatically setting aside 30% of everything I bring in for taxes, to establishing monthly distributions to my personal account, to forecasting revenue for the coming fiscal year – Tom has completely perfected the art of making my business run. And at our last monthly meeting, I asked Tom if he would be willing to share a little insight with my fellow professional photographers and I’m grateful to have a few words of wisdom for you today!

1) Why should small business owners hire a business accountant to handle bookkeeping and financial planning?

“Hiring a business accountant is important because it allows you to make educated financial decisions regarding your business. It’s so critical when a business is newly formed and starting to grow to make certain you don’t make mistakes with your money. Having a business accountant allows you to see and understand exactly how your operating and also will allow you to project the financial effects of your decisions. Whether it’s deciding when it’s time to take that first paycheck or even how much and how frequently you can pay yourself. One of the challenges I face is helping small business owners understand that having a business accountant isn’t an overhead expense, it’s an investment in your future. A good business accountant pays for themselves by helping you maximize your profitability.”

Natalie’s Note: A good business accountant not only pays for him or herself by helping you to maximize profitability, but also by securing your business in the event that you are audited. Keeping your business finances documented, organized, and categorized properly is legally required by the Internal Revenue Service. Having a financial professional monitoring every daily, weekly, and monthly statement gives me an added sense of security in knowing that I’m doing everything completely by the book.

2) What are a few of the biggest mistakes that small business owners make regarding accounting or finances?

“The biggest mistake I see is not recognizing the difference between a bookkeeper and a business accountant. When the accounting side of your business is viewed as an overhead expense the first instinct is to hire an inexpensive bookkeeper. The problem with that is your not getting the “investment” part of this decision. Your getting someone who is taking over the accounting data entry for you but that doesn’t mean you are getting someone with a proven business portfolio. It may cost you a little more money to hire someone that has higher level accounting experience but the payoff is immeasurable. You can benefit from their business contacts, learn from their experiences both good and bad, and most importantly you will be able to receive the insight and reporting that can help you grow your business intelligently. As an example, who would you rather hire, a second shooter that knows how the camera works or someone with proven photography experience? The first person will certainly cost you less but in the end you’ll be disappointed in the results.”

Natalie’s Note: I love Tom’s second shooter analogy. As with anything in life, you truly get what you pay for. And hiring a well qualified professional, whether it’s an accountant or wedding photographer is an investment that you won’t regret.

3) What is your biggest tip for professional photographers to help them grow / strengthen their business?

“I think it’s important to budget for the winter months. The most successful photographers I work with have a year round plan that enables them to get through that vicious stretch from January to March without having to live on Ramen noodles. Instead of suffering during those times they are able to focus on expanding their business. Most importantly they are able to have a stress free time to get themselves focused and ready for the coming busy time. Going into the spring with a clear head, a good plan and a positive attitude improves your quality of life and allows you to have more successful interaction with clients.”

Natalie’s Note:  Tom’s third point really hit home for me! The Post-Holiday months of winter are often a period of starvation for photographers, especially those who shoot primarily outdoors or bring home the majority of their income from weddings during the spring, summer, and fall. But with this drop in photographic commissions – comes a rise in potential time to start new projects and plan for the future of your business. By establishing a strong financial plan for my business now, setting aside proper amounts for taxes and savings, and creating a steady cash-flow, I already know that my paychecks will be there even when the amount of revenue being generated slows in the winter.

If you’re looking to hire someone to help you with business accounting, I highly recommend Tom Barnhill! He is based in Annapolis and has a specialty in wedding-related small businesses! I’m not a spokesperson for Tom nor am I getting compensation for telling all of you how much I love him – although, I might see if this post gets me a free Starbucks Latte at our next meeting! 😉 I just firmly believe that each and every one of you deserves a “Tom” standing behind your business. Hiring a business accountant has already pushed my business further than I could have imagined and has allowed me to begin dreaming even bigger for the coming years!

Leave a Reply Cancel reply

© 2023 Natalie Franke

/

/

/

/

/

Word! Couldn’t agree more!

This is such a great post with so much helpful information!

Such useful information!!

this is such a well written and informative post! thank you!

This is so helpful, Natalie! Hiring an accountant is something I’ve been thinking a lot more about since my business is growing a lot and I’m also starting other ventures. John actually went to school for accounting, but it would be really neat I think for us to sit down with someone who actually works specifically with wedding professionals!

Love the post Natalie! Tom has handled the accounting for my wedding business for 10 years and couldn’t be happier. Of course, I do think he’s kinda cute too! 🙂 Love the photos!!!

My accountant is my favorite person in my business team. Now, using Quickbooks, I can pull up exactly how well I’m doing at any point, what my expenses are, everything. It is so empowering!!

Natalie – what a great post! Thank you for being willing to SHARE so much of how you have run your business! You are wonderful.

So smart and yes to all these points!! It is so important to iron things out so off-season isn’t poor season! haha 🙂 Love it.

This is such a helpful post! You’re so business savvy Nat!

[…] my Accountant and Wedding-Industry Financial Expert, Tom Barnhill. You may remember him from this earlier post and he works with quite a few photographers around the East […]

An accountant that specialize in wedding related businesses? Wow, that’s seriously smart.

I think what a lot of us wedding photographers want to know is how do you find such a person? I can’t seem to type the right terms into Google to find anything other than photography tips and advice for photographers rather than an actual accountant who’s marketing their services to photographers.

There are quite a few! 🙂 Tom is with Business by Barnhill http://www.businessbybarnhill.com/ and I also love Steadfast http://www.steadfastbookkeeping.com/