Today I’m kicking off a new blog series that I’m incredibly excited about… Tech-Talk Tuesdays! When we relaunched my website earlier this year, I had a goal to begin blogging more about photography and what it takes to run a successful small business. And I’m excited to start this series off with a guest-post by my Accountant and Wedding-Industry Financial Expert, Tom Barnhill. You may remember him from this earlier post and he works with quite a few photographers around the East Coast.

Those of you who know me – know that I’m a positive person, an optimist, who always looks for a way to see the world as a beautiful and wonderful place… but I believe in Keeping it Real and always speaking honestly about my experiences, which can sometimes mean facing tough questions and taking a hard look at what it takes to run a business successfully. There needs to be an honest dialog about these topics accompanied by a helping-hand to support young photographers in their dreams of being successful. And that is why this series is so important to me.

“Running a Small Business is very, very hard. I’m not going to sugar-coat it. I’m not going to pretend that there aren’t days when I wonder why, oh why, I am just crazy enough to chase after my dream. There are times when my life is a constant breathless marathon of shooting, editing, emailing, and the million other hats that I wear as a business owner. But I made a choice very early on in my life, that I would rather work 60-hours a week following my heart and running my own business, than 40-hours in a back office cubicle.” [From: Running a Photography Business]

Little known fact:  Before transferring to Penn to pursue my degree in Visual Studies, I was an Econ Major at Towson’s Honors College. Yep. This creative that you see before you was, at one time, looking to major in business. And although I switched to a different area of study when I moved to Philadelphia, I’ve always had a love for learning more about business and the mechanics that enable one institution to succeed while another plateaus or fails entirely. I find it fascinating. And this curiosity combined with real-world experience of operating a business for four years while in school and now two years full-time has taught me quite a bit.

So get things started, we’re going to approach the idea of how much you truly need to make in your business for it to be a genuine source of income. Essentially beginning the conversation of: Can you truly make a living doing what you love? I’ll let Tom take it from here:

“I just want to be comfortableâ€

These are dangerous words for a small business owner. All too often I meet with a potential client and ask them what their goal is? I frequently get the answer – “I just want to be comfortableâ€. Where it gets interesting is when I ask them “how much do you need to earn to be comfortableâ€? This is often met with an admission that they don’t know. The reason this answer is dangerous is because it can set in motion a cycle of perceived failure that takes the fun out of being a small business owner. To avoid it I have some steps you can take to save yourself from this demoralizing situation.

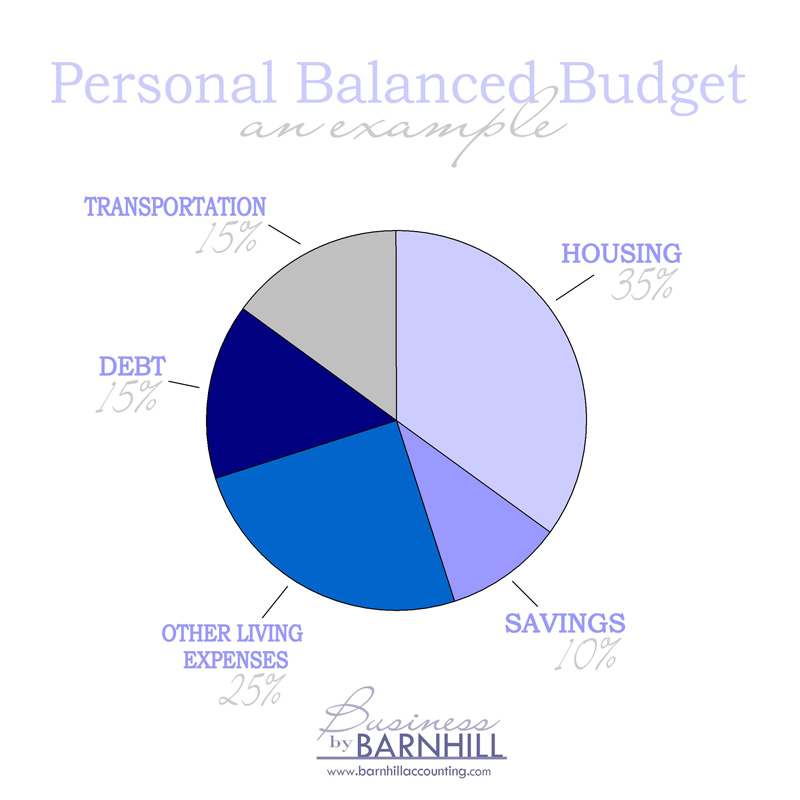

The first step is determining how much you need to earn with your business. This starts with a basic understanding of creating a personal budget. While every person’s situation is different, the chart shown below will give you a rough idea of how to balance your finances. Once you have an amount that your business must earn to provide financial stability it’s time to ask a few questions:

Is your business capable of generating this number?

Keep in mind the amount of revenue your business generates is not the same as how much your business earns. You have to be able to reach your personal number after you’ve paid your business expenses and taxes while at the same time leaving enough cash in the business to allow it to operate effectively.

Natalie’s Note: In an upcoming post, I’m going to demonstrate a revenue breakdown to show how much of my income actually translates into profit, and this amount may be lower than you would expect! When you first start out, rarely do you realize how much you need to set aside for taxes, insurance, equipment, materials + supplies, and all of the other expenses that go into running a successful business!

How long will it take to reach this number?

Most businesses start slow and grow over time. It’s important to have reserves so you can allow your business the time it needs to develop organically. Getting into financial stress right out of the gates will cause you to make poor business decisions that can ultimately result in your business failing.

Natalie’s Note: Starting a photography business is expensive in particular because of the high cost of the equipment that is needed to operate successfully. A camera body can run anywhere from $2,000 – $6,000 and most wedding photographers have two or more bodies to ensure they can capture a couple’s big day. This means that many photographers don’t turn a profit their first year (or even two years) in business. Their expenses are higher than the amount of revenue that they can initially generate.

Are the requirements for reaching my number acceptable?

This is the most critical and often overlooked piece. Can your business reach the financial stability you seek without destroying every other part of your life? If reaching your number means you have to work 80-120 hours per week and you don’t have time for anything else, will that fulfill you?

Answering these questions is best done through a business plan. Having both short term and long term goals to measure your progress against so you make sure you stay on a path to success or in some cases determine that your plans need to change before you’re in a situation that can have long term repercussions.

Without considering these things it’s easy to fall into a trap where you have to work excessively without reaching any level of gratification or feeling guilty about neglect other aspects of your life. The counterpart to that is making the other parts of your life a priority but never feeling like your business is as successful as it should be. In the end you have a feeling of failure in some area of your life that simply isn’t fair to you. Understanding your priorities while setting and achieving both short and long term goals will allow you to find a better balance in your life and also feeling the success you both strive for and deserve.

Discussing budgets, finances and business planning can scare the hell out of many people. Odds are you’re not starting your business because you’re a great business person. You’re starting it because you have a great idea or are amazingly talented in other ways. If finances or business planning aren’t your specialty, find help. No one starts a business having all of the answers.

The truly successful entrepreneurs are willing to admit where they have weaknesses and they find the help they need to insure those weaknesses don’t result in a failed business.

Natalie’s Note: This is a big point I want you to take home from today’s post. We all have strengths and weaknesses. And identifying those weaknesses allows you, as a small business owner, to outsource that portion of your workload to someone who is more efficient, and skilled in the subject area.

For me personally, I learned early on that I dreaded accounting… So I invest every month in having Tom manage Quickbooks, handle my bank reconciliations, Monthly Sales Tax Payments, Financial Projections, and more. He takes care of the financial health of my business so that I can focus on things that I am better at and enjoy doing as a photographer.

On the flip-side, one of my strengths over the past year has been maintaining an efficient workflow! I have a really fast culling + editing process and deliver most of my weddings within 5 – 7 days. Editing is not an issue for me at this point in time so I do all of that in house (rather than outsourcing to an editor like many of my colleagues). Leveraging your strengths and identifying your weaknesses is key in order to run an efficient and successful business in the long run.

I hope today’s post was helpful for all you! My goal is to make Tech-Talk Tuesday an ongoing dialog and a place where I can answer your questions… So if you have any topics you’d love to hear about, let me know!

What would you like me to write about going forward?

Send me an email or leave your suggestions in the comments below!

Leave a Reply Cancel reply

© 2023 Natalie Franke

/

/

/

/

/

This is so great! Can’t wait to come back and read all the new posts! Thank you for sharing all that amazing info!

This is WONDERFUL!!! It is so fabulous to hear how other small businesses work, advice on structuring, etc.! (Even more valuable coming from a lovely business owner like yourself!! ;-)) Thanks for sharing!! xo

Love this! Thanks for sharing Natalie!

Love it Nat!!! Thanks for sharing with us! Xoxo!

How to develop a business plan with examples

You’re always so generous. Thanks for being there for those young, and old, photos! I appreciate you so much!

This is great for those starting new businesses or those already established to take a look at where their business stands!

Oh my gosh! I love it! Everyone need to hear the truth from a generous person like you! You’re amazing! xo

Great idea for a series! Can’t wait for more!

SUCH A GREAT POST! Tom is so wonderful for sharing his help and knowledge with us!! Thank you for this!

All weekend I have been putting off this & I woke up this morning full of intent to do the ‘business’ aspect and look for an accountant that can do all of that for me! Thank you so much for sharing!

Totally agree … running a small business is hard, but it’s so amazing when you do what you love!

Such an awesome post!! I can’t wait to read more!

I love this new series! I’d love to hear about your file back-up process, more about developing a business plan and how you cull/edit so fast 🙂

I went to business school and still find running my own business to be a challenge haha

This is an excellent idea! Not to mention, some much needed advice!

This is wonderful! Will definitely continue to read your helpful blog every Tuesday! Thanks for the advice 🙂

Too funny. I was just thinking about all these topics today! Thank you for the insight! Very helpful!

This is a great series! Can’t wait to read more. Yes, running a business is much harder then people think! Love this.

Love this post & can’t wait to read more in this series 🙂

This advice is amazing, Natalie! I absolutely appreciate how you broke everything down and gave specific information. I can’t wait to read more from this series!

I love this so much!! Thanks so much for sharing… can’t wait to continue to follow!

This was amazing!! Thank you for sharing.

I think people jumping into photography frequently make many mistakes, that would have been avoided with some planning. Mistakes such as not knowing their costs of doing business can be seriously detrimental and cost them a ton down the line.

Great start to the series!

Could you answer in a tech-talk Tuesday the equipment you used for your photography business when you stared out and any other helpful hints in ways to continue your photography education outside of experience when you were starting out.

Katie, YES! I do have a little equipment list, here – – but I have an idea for a few posts on equipment + education that are in the works!! Thank you for following along!!

I love this post! Thank you for sharing. I have many things to learn, so step by step I will have to apply these suggestions. Your turn around to complete weddings are amazing. I wonder how many pictures generally you give to the client, and if you do all your editing in LR or do you open them in photoshop as well. I will continue reading your blog, you might have answered this somewhere already. Thanks again!